What has S&P said about India?

- Standard & Poor’s (S&P) has maintained a “negative” outlook on the Indian economy and cautioned that it could downgrade the country’s sovereign ratings if the next government “does not appear capable of reversing India’s low economic growth”.

|

What has

it said about India’s credit rating?

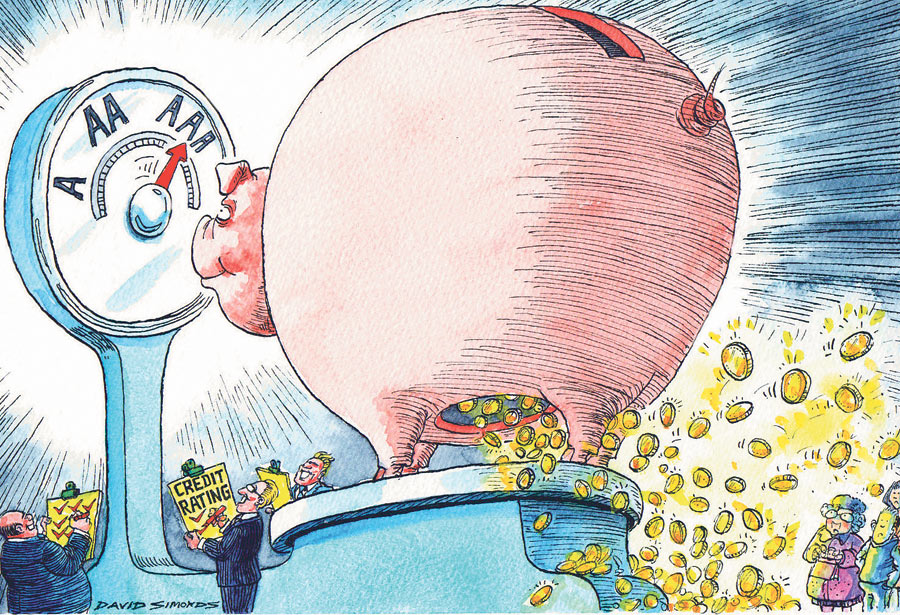

- The agency maintained India’s rating at BBB-, which is just a notch above “junk” that carries a higher risk of default by the government, but placed the onus squarely on the next government to turn the economy around.

- The negative outlook indicates that it may lower the rating to speculative grade next year if the government that takes office after the general election does not appear capable of reversing India’s low economic growth.

- According to the credit rating agency, if it believes that the agenda of the new government after the 2014 Lok Sabha elections can restore some of India’s lost growth potential, consolidate its fiscal accounts, and permit the conduct of an effective monetary policy, it may revise the outlook to stable.

If, however, it sees continued policy

drift, it may lower the rating within a year.

How will a downgrade affect India?

A downgrade will erode India’s attractiveness as a global business hotspot and investment destination.

A downgrade will erode India’s attractiveness as a global business hotspot and investment destination.

What is credit rating all about?

A credit rating evaluates the

creditworthiness of a borrower. Corporations and governments issue bonds to

borrow money.

What does it mean in connection with

bonds?

- When you buy a bond, you are lending your money to someone — the government or a private company entity that promises to repay within a specified tenure.

- Credit ratings, as explained earlier, represent the ability of the bond issuer to repay.

- A higher rating implies that the bond issuer has lower likelihood of defaulting on payments..

How are these calculated?

- There are no specific mathematical formula.

- Agencies use public available information, historical trends, discussions with government officials and the future outlook to determine credit ratings.

What is the rating scale?

- Rating scale is as follows, from excellent to poor: AAA, AA+, AA, AA-, A+, A, A-, BBB+, BBB, BBB-, BB+, BB, BB-, B+, B, B-, CCC+, CCC, CCC-, CC, C, D.

- Anything lower than a BBB- rating is considered risky.

Who calculates credit rating?

- Moody’s, S&P and Fitch Ratings are among the ones which operate worldwide.

- In India, commercial credit rating agencies include CRISIL, CARE and ICRA, among others.

Whom does the credit rating benefit?

It is used by individuals and entities that purchase the bonds issued by companies and governments to determine whether the borrower will repay as promised.

It is used by individuals and entities that purchase the bonds issued by companies and governments to determine whether the borrower will repay as promised.

What is a junk bond?

- Bonds that have higher credit rating are also known as investment-grade bonds.

- Bonds that have very low credit rating are known as junk bonds because of a stronger likelihood of default.

What about other BRIC countries?

- Among the four ‘BRIC’ countries, India currently has the lowest credit rating and is the only one with a negative outlook.

- Russia and Brazil have ‘BBB’ long-term foreign currency ratings and China has an ‘AA-‘ rating, and all three have stable outlooks.

- China was the first BRIC sovereign to receive an investment-grade rating from Standard & Poor’s (in February 1992), followed by Russia (in January 2005), India (in January 2007), and Brazil (in April 2008).

Why is the timing of report so critical?

The report comes as India’s

macroeconomic managers struggle for solutions to deal with a string of economic

crises as mirrored in recent data that confirmed signs of a crippling

industrial slowdown.

What has recent data showed?

India’s economy has slowed to a growth rate of 4.4% in the April-June quarter of 2013-14, the slowest in four years. Companies are seeking to cut corners to stay competitive.

India’s economy has slowed to a growth rate of 4.4% in the April-June quarter of 2013-14, the slowest in four years. Companies are seeking to cut corners to stay competitive.