Kahaani k

Kirdaar !!

- Mauritius.

- Modiji and his

visit to Mauritius.

- Convention

for Avoidance of Double Taxation and Prevention of Fiscal Evasion.

- Income Tax Department and CBDT

- past

UPA regime.

- Ketan

Parekh scam.

- MoF

and MEA.

|

toh kahaani 1982 se shuru hoti hai !!

- The

Convention for Avoidance of Double Taxation and Prevention of Fiscal

Evasion, relating to taxing income and capital gains, which was signed in

August 1982, and notified by the Indian government in December 1983, when

Indira Gandhi was Prime Minister and Pranab Mukherjee her Finance

Minister.

- In 1982, Mukherjee announced liberalisation of investment norms for NRIs, including buying into stocks of listed firms in India.

- Months

later, fearing a coup in the island nation Mauritius with which India has

had close historical and

cultural links, India sent its

troops to support Prime Minister Anerood Jugnauth. It is in keeping with

the strategic interests of India

in the Indian Ocean that the 1982 agreement was signed.

|

- As

India opened up its stock markets to foreign funds and portfolio investors

in 1992, many of them

progressively started routing their investments through Mauritius.

so what is the bone of contention ?

- This DTAA has

been at the centre of

negotiations between the two countries for close to two decades — with

concerns over the ABUSE of the treaty, and ROUND - TRIPPING of funds of

Indians through Mauritius back to their home country in the form of

foreign investment.

yaar what is this ROUND TRIPPING , DTAA

and all stuff ...please explain in simple words and detail..how all this

happens !! (here we go !)

- Thirty three years back Government of India negotiated a

Double Taxation Avoidance Agreement (DTAA) with Mauritius. Under this, tax payers who reside in one country and earn their

income in another would not be taxed twice for the same income. However, this had, in effect, led to a

situation where the entities concerned would avoid paying taxes in both countries.

- This was because a Mauritian entity could avoid capital

gains tax made in India, as India is not a ‘resident’ country, while not

paying taxes in Mauritius as well, which does not levy the tax on its

citizens.

- India which levies capital gains tax on the sale of

shares under the Income Tax Act, 1961, gave up this right under the DTAA.

- This ushered in billions of investment into India in the

last 15 years. Some reports indicate that investments in the last one and

a half decades would be around Rs 4.63 lakh crore. It also led to more and more investors

holding shares of Indian entities through a holding structure in

Mauritius. As a result, real value was created in India, but the asset

value accrued to Mauritius.

- It worked like this: if you were to sell shares of an

Indian entity, capital gains tax was payable. On the contrary if the shares

of the holding entity in Mauritius were to be sold, which has no

independent economic value other than the underlying value of the Indian

subsidiary, it is exempt from capital gains tax both in India and in

Mauritius!

- Mauritius became a "tax haven" for investments

both “foreign” and “domestic” (routed through foreign jurisdiction) to

flow freely into India. A 10 per cent margin or saving on the cost

of money was a huge incentive for investments.

- It also potentially became a route for

bringing in black money and terror funds and ‘round tripped’ money — local

funds being squirreled out of India and returning as foreign capital,

thereby avoiding taxes.

- Thus good and evil started to co-exist as

inevitable sesame twins in the Indian investment market. The

Mauritius route worked well for politicians, smugglers, anti-nationals and

terrorists and their associates. It was exploited to win elections,

smuggle drugs, foment terrorism and promote human trafficking.

|

NDA government (Atal Bihari Time !)

- Inflows started rising towards the end of that decade, and in the early part of the NDA government headed by Atal Bihari Vajpayee.

- But in April 2000, there was controversy after foreign institutional investors received notices from the Income-Tax Department demanding payments even though these investors argued that they were exempt under the tax treaty.

- With FIIs selling and the government worried over stock markets tanking and the rupee taking a hit, the Central Board of Direct Taxes under the Finance Ministry headed then by Yashwant Sinha, issued a circular to clarify the law and virtually negate the Income-Tax orders. (vested interests probably..news reports of protecting his daughter in law !)

- The Mauritius tax treaty came into sharper focus in 2001 when the stock market scam linked to Ketan Parekh blew up, leading to a probe by a Joint Parliamentary Committee.

- After the JPC report and criticism, the government started negotiations with the Mauritius government to review the double taxation avoidance agreement in an effort to plug some of the loopholes.

- India

wanted its bilateral partner to put an end to what were known as “post-box companies”,

which just served as addresses to help investors take advantage of the

treaty to make substantial gains.

MoF vs. MEA

- While

the Finance Ministry’s concern then and later was over the loss of revenue

and misuse of the treaty, the Ministry of External Affairs had diplomatic

and strategic interests in Mauritius as the gateway to Africa — leading to

a pushback every time the issue was sought to be forced.

UPA regime ~!

- After

the UPA government came to power in 2004, policymakers decided to take

another hard look at the tax treaty. Prime Minister Manmohan Singh

assigned a group of officials headed by a senior Indian diplomat, Jaimini Bhagwati — who had worked earlier in the Ministry of Finance as a

joint secretary handing the capital markets division — to discuss the

issue with Mauritius.

- The

team, which had representatives from the Revenue Department and tax

officials, went to Mauritius for a couple of days, and submitted a report

to the PMO on the provisions of the treaty including grandfathering or phasing out progressively the capital gains

tax treatment so as not to

rock the stock markets, and to avoid uncertainty.

[ok but what is this GRANDFATHERING

treaty/agreement/clause ?

- A grandfather

clause (or grandfather policy) is a provision in which an old

rule continues to apply to some existing situations while a new rule will

apply to all future cases.

- Those

exempt from the new rule are said to have grandfather rights or acquired

rights.

- Frequently,

the exemption is limited; it may extend for a set time, or it may be lost

under certain circumstances.

- For

example, a "grandfathered power plant" might be exempt from new,

more restrictive pollution laws, but the exception may be revoked and the

new rules would apply if the plant were expanded.

- Often,

such a provision is used as a compromise or out of practicality, to allow new rules to be

enacted without upsetting a well-established logistical or political situation.

- This

extends the idea of a rule not being retroactively

applied.]

|

back to story

- Yet,

and despite senior delegations led by the CBDT chief also visiting

Mauritius later for negotiations, there was resistance on a review of the

agreement — with Finance Ministry officials hinting often that their

stance was at variance with that of the External Affairs Ministry.

- Through

the decade of the UPA government (POLICY

PARALYSIS), the final step

couldn’t be taken.

- What

may have added to the caution was the fact that Mauritius had, over a

decade or more, emerged as the top FDI destination for India,

and as India’s top trading partner.

toh MODIJI k aane se kya ho gaya ji ?

..acche din aaye kya ?

|

- A

little after Prime Minister Narendra Modi visited Mauritius in March 2015, India’s

negotiators are at work on redrawing a historic agreement signed over 30

years ago between the two governments.

- So

what will this redrawing/amendment do ? -- The amendment to the over three decade old

Double Taxation Avoidance Treaty (DTAA) between India and Mauritius has

been seen as a progressive and much overdue tax reform measure. In another

two years, an entity which is a resident of Mauritius, cannot avoid paying

income tax on capital gains arising in India. This is expected to plug a

huge source of revenue leakage and capital flight.

So what are

these key features like ?

Its key features are:

- All investments

up to March 31, 2017 will remain under the old regime i.e. ‘double

non-taxation’. They will neither be taxed in India nor in Mauritius.

- Between 2017

and 2019 capital gains would be taxed at 50 per cent of the domestic tax rate subject

to the fulfilment of the Limitation of Benefits . The full rate would

apply after 2019.

- The

interest arising in India to Mauritian

resident banks will be subject to withholding tax in India at

7.5 per cent after March 31, 2017.

Ab chalte hai IMPACT ki taraf !!!

Will foreign investments as a whole witness a

decline as a result of the move?

- Since

investments until March 31, 2017 have been exempted from capital gains

tax, there is no risk of an immediate outflow of funds.

- However,

the protocol will impact all prospective investments with effect from

April 1, 2017.

- Also,

the benefit of the two-year transition period will be limited to companies

that are not regarded as a shell/conduit company, and their total

expenditure on operations in Mauritius has been at least Rs 27 lakh in the

preceding 12 months.

- Experts feel that while some investors who are bullish on

India may advance their plans and invest before April 1, 2017 in order to

save tax ( je

toh acchi baat hai..fast investment..fast job creation...fast acche din ), many others will raise their due diligence procedure on

investments, factoring in the tax cost in the returns they generate.

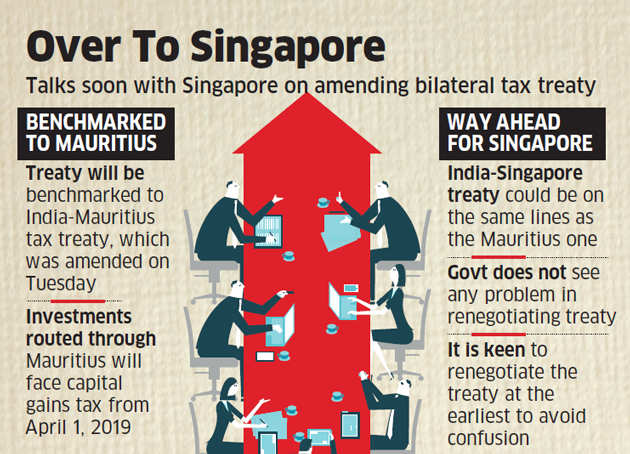

So,

will investments through Singapore also get the grandfathering provision?

|

- Article 6 of the

protocol dated July 18, 2005 to the Singapore Tax Treaty says that the capital gains exemption under the Singapore Tax

Treaty would remain in force only till the time Mauritius Tax Treaty

provides for capital gains exemption on alienation of shares.

- Therefore, the

benefits accorded under the Singapore Tax Treaty would fall away, unless

amended.

- Now that

Mauritius treaty stands revised, accordingly the Singapore treaty will

also have to be revised.

- While it is

expected that benefits of the Singapore treaty would also be available

until March 31, 2017, experts hope the government would provide

a level playing field for investments, and avoid arbitrage between

jurisdictions.

- The

grandfathering provisions should, therefore, be built into the Singapore

Tax Treaty as well.

Accha

is any country likely to benefit as a result of the amendment?

- Experts

say the Netherlands may emerge as an alternative.Netherlands may emerge as

an attractive destination for FPIs following the changes to the Mauritius

treaty.

- The India-Netherlands treaty is a smart treaty, and it can emerge as a preferred alternative for FIIs

especially those in Europe.

- The treaty provides that if a company based in Netherlands

holds less than 10% equity in an Indian entity, it would not attract

capital gains on the sale of those shares to residents or

non-residents.

- Even if it were to own more than 10% equity in an Indian

company, the treaty allows it to sell the shares to a non-resident without

attracting tax.

Ok ....now lets become THE HINDU and

CRITICISE and find LOOP HOLES !!

REDRAWING kar rahe ho...woh toh thik

hai ...LEKIN ...LEKIN ?

- a more disturbing question has been overlooked: Does

the new protocol discriminate between money meant for bona

fide economic activity and that which originates from dubious

sources — shell companies, foundations and NGOs (remember

'intolerance saga') — with security implications? This issue needs to be

closely examined.

At first glance, the protocol appears to be a

panacea for all evils. But, a closer look reveals that this attempt would only

eliminate good investments in the next three years..... kyun be ?

- The Supreme Court while deciding on the Vodafone case, declared

that in deciding on taxation, the basic parameter should be whether the

investment is being used for generating wealth and employment in

legitimate business activities.

- Therefore, funds

associated with shell/conduit companies, charities, foundations and NGOs

were not to be spared.

- The judgement significantly declared that the source of investment was not important, so long as it created wealth and employment. On the

contrary, if the investment

was dubious, it should be

hunted down and brought to tax.

But what does this protocol seek to achieve?

Legitimate

and illegitimate investments do not share common traits. A legitimate

investment into a business helps the economy progress. An illegitimate hawala

transaction hurts it. The protocol pursues a limited economic objective of

taxing a transaction which otherwise remained outside India’s realm.

This protocol is now going to serve as a washing machine (ohho

remember 300 movie's sequeal :D !).

- Evil will now legally join the club of the good, so long as it chooses to pay capital gains tax.

- The only difference between the Vodafone judgement

rendered by the Supreme Court and this protocol is that the former

suggested exempting good money from taxation.

- Now, all that one has to factor in is a 10 per cent

capital gains tax.

- Once that is paid, India can be flushed with

illegitimate investments.

- This could lead to a legitimate investment with capital

gains tax considering a different destination.

WAY FORWARD ?

The need of the hour is twofold.

- Without

a doubt, share transfers which stood exempted from time immemorial need to

be taxed. This protocol has rightly designed a progressive transformation.

- But

that is not sufficient. Coupled with this, the protocol should

have added filters, check points and agencies and bodies to go into the

very source and nature of investments.

The idea cannot be to tax any investment, good or bad. A

two-pronged attack could have been worked out: tax good money, which stood

exempted till date, and prevent evil investments from entering India. A more likely consequence of this protocol is that good investment

will start shrinking and illegitimate investments will thrive.

Moral of

the Story !

- Inspite of all this , it signals a major political achievement

by the government. It is also a signal that India, now a $ 2 trillion

economy with foreign exchange reserves of over $ 350 billion, doesn’t need

hot money flows, and is more confident of attracting FDI.

- The new arrangement, marked by a concessional capital gains regime for two years, kicks in in 2017, and a new agreement by 2019. That will be the true test of capital flows and investment and investor confidence.

- And u must also say thanks to the G20 initiative of BEPS i.e. Base Errosion and Profit Sharing ...(dont know read here http://swapsushias.blogspot.in/2016/01/bye-bye-mauritius-tata-tata-luxembourg.html)